Article submitted by Matthew Shirley, Leasing and Sales Agent for Saurage Rotenberg Commercial Real Estate

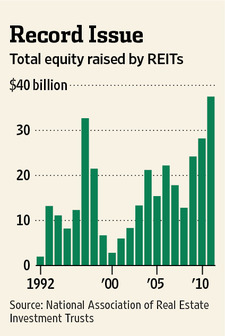

Written by A.D. Pruitt, The Wall Street Journal Jan. 4, 2012Real-estate investment trusts raised a record-breaking amount of equity in 2011, which analysts believe will be used to pursue acquisitions.REITs issued $37.5 billion in initial and additional common and preferred shares last year, according to the National Association of Real Estate Investment Trusts. That was up 32% from 2010 and was the largest amount of REIT stock issued since the securities were established in 1960.

The previous record was in 1997, when $32.7 billion of REIT stock was sold to the public.

REITs have been raising large amounts of equity for past three years. Proceeds from the earlier stock sales were used mainly to restructure balance sheets and reduce debt to survive the economic downturn.

But now that most real-estate companies have recapitalized, analysts and investment bankers say proceeds from recent stock sales will be used mainly for acquisitions.

“Judging what we see in the pipeline, we expect a very robust 2012 in the REIT space” for acquisitions, says Joe Coco, a partner in the mergers and acquisitions division at Skadden, Arps, Slate, Meagher & Flom LLP. “REITs are in a very strong position right now,” said Mr. Coco, adding that he anticipates commercial landlords in all property types to aggressively seek acquisitions.

REIT stocks racked up total returns of 7.54% in 2011, outpacing the 2.1% gain in the Standard & Poor’s 500-stock index but slightly trailing the Dow Jones Industrial Average’s return of 8.38%.

Analysts had expected 2011 to be a big year for REIT acquisitions. But the downgrade of the U.S.’s credit rating in August and concerns about Europe’s debt crisis prompted some companies to turn skittish about acquisitions.

REITs made $34.6 billion in commercial real-estate acquisitions in 2011 that comprised 2,322 deals, according to CoStar Group. Although that was 40% higher than the previous year’s volume, it fell short of expectations.

But now that the outlook for the U.S. economy has improved, investors are expected to be more emboldened to take on risk by buying new shopping malls, office buildings and apartment developments. Confidence has been restored, in part, by recent consumer spending and jobs data that signal a declining probability of a double-dip recession.

In a sign of renewed deal activity, Ventas Inc., one of the nation’s largest health-care landlords by market capitalization, recently agreed to acquire Cogdell Spencer Inc. in a deal that Ventas valued at about $760 million, including debt. That would be the largest REIT merger since February, when the Chicago-based company acquired rival Nationwide Health Properties Inc. for $5.8 billion.

REITs, established to give individuals a convenient way to invest in income-producing real-estate assets like shopping malls, office and apartment buildings and hotels, are required to pay at least 90% of their taxable income out as dividends.

To read this article in its entirety click HERE.Subscription may be required

To view this week’s Featured Property click HERE.

Matthew Shirley joined Saurage Rotenberg Commercial Real Estate in January 2011. Matthew is a graduate of Louisiana State University with a degree in International Trade and Finance. While at LSU Matthew was a member of Omicron Delta Epsilon The International Honor Society for Economics. Matthew’s professional memberships include the Greater Baton Rouge Association of REALTORS® Commercial Investment Division and the Louisiana Commercial Data Base (LACDB).

Saurage Rotenberg Commercial Real Estate is a member of the Baton Rouge Area Chamber of Commerce (BRAC); the West Baton Rouge Chamber of Commerce; the Baton Rouge Growth Coalition; the Baton Rouge Better Business Bureau; the Louisiana Commercial Data Base (LACDB); and the International Council of Shopping Centers (ICSC). Several agents, on an individual basis, are members of the Society of Industrial and Office Realtors® (SIOR), the Certified Commercial Investment Member Institute (CCIM); the National Association of REALTORS® (NAR); and the Greater Baton Rouge Association of REALTORS® Commercial Investment Division (CID).