Investors pursue opportunities in the heart of the city

Article submitted by Ryan Eaton, Commercial Sales and Leasing Agent for Saurage Rotenberg Commercial Real Estate

Written by Rich Rosfelder [Commercial Investment Real Estate (CCIM.com) / May – June 2011]

At the Chatham Market retail center on Chicago’s South Side, shoppers may be surprised to find a new convenience store tucked in next to a Potbelly’s sandwich shop this summer: Walmart Express. Slated to be its first urban location, the store will occupy a mere 10,000 square feet. Walmart plans to open more than 30 small-format stores in U.S. cities this year.

And it’s not the only major retailer setting its sights on urban markets. Target plans to open 10 small-format CityTarget stores by the end of next year, and Best Buy expects to add 150 Best Buy Mobile stores in fiscal 2012.

This growth strategy makes sense, since more than 80 percent of the U.S. population resides in urban areas and convenience is highly valued by shoppers. But it also represents one of the fundamental changes in the retail property market landscape. And investors are taking notice.

“The majority of the investors I talk to are focused on urban infill, value-add product with maturing leases and a need for new physical plant,” says Bill Rose, Western regional director of Marcus & Millichap’s National Retail Group. “Walmart’s grocery concept is a huge sign of the direction things are going.”

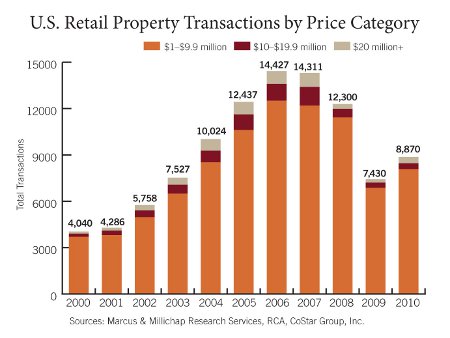

This boost in interest reflects a wider improvement in the sector. In 2010, the retail property market saw a 41 percent increase in sales volume to an estimated $47 billion, according to Marcus & Millichap, which forecasts an additional uptick of more than 25 percent this year. Blackstone Group’s recent $9.4 billion purchase of Centro Properties Group’s U.S. shopping center portfolio is a clear benchmark in this upward trend.

The growth in retail investment sales, small and large, indicates that a recovery is on track. But as online shopping increases and owners compete for traffic, a revitalized retail property market may look quite different than it did just a few short years ago. Like the major retailers and sector investors, CCIMs are adjusting their strategies accordingly.

To read this article in its entirety click HERE.

To view this week’s Featured Property click HERE.

Ryan Eaton joined Saurage Rotenberg Commercial Real Estate in 2011. Ryan is a graduate of Lee High School and Louisiana State Universtiy (LSU) where he earned a Bachelor of Arts degree with concentrations in business, sociology and speech communication. Ryan’s professional memberships include the Greater Baton Rouge Association of REALTORS® Commercial Investment Division, Louisiana Commercial Database (LACDB) and the International Council of Shopping Centers. He is also a member of the Baton Rouge Advocates for Safe Streets (BRASS).

Saurage Rotenberg Commercial Real Estate is a member of the Baton Rouge Area Chamber of Commerce (BRAC); the West Baton Rouge Chamber of Commerce; the Baton Rouge Growth Coalition; the Baton Rouge Better Business Bureau; the Louisiana Commercial Data Base (LACDB); and the International Council of Shopping Centers (ICSC). Several agents, on an individual basis, are members of the Society of Industrial and Office Realtors® (SIOR), the Certified Commercial Investment Member Institute (CCIM); the National Association of REALTORS® (NAR); and the Greater Baton Rouge Association of REALTORS® Commercial Investment Division (CID).